Again, Naira Hits N1,825 to Dollar Despite EFCC Rescue Attempt

Tuesday saw the naira plummet further, reaching N1,825 against the dollar, despite the Economic Financial Crimes Commission’s (EFCC) efforts to disrupt the activities of suspected manipulators and speculators.

It was reported on Monday about the EFCC’s raid on the prominent Abuja Zone 4 market, where they fired shots at Bureau De Change operators in an attempt to halt the naira’s rapid decline.

However, less than 24 hours after the EFCC’s raid on BDC operators in Abuja, the naira continued its swift decline, dropping from N1,700 against the dollar to N1,825 within a day.

This occurred as the naira hit its lowest point ever against the dollar and pound sterling in Nigeria’s history, despite efforts by the Central Bank of Nigeria to stabilize its free fall.

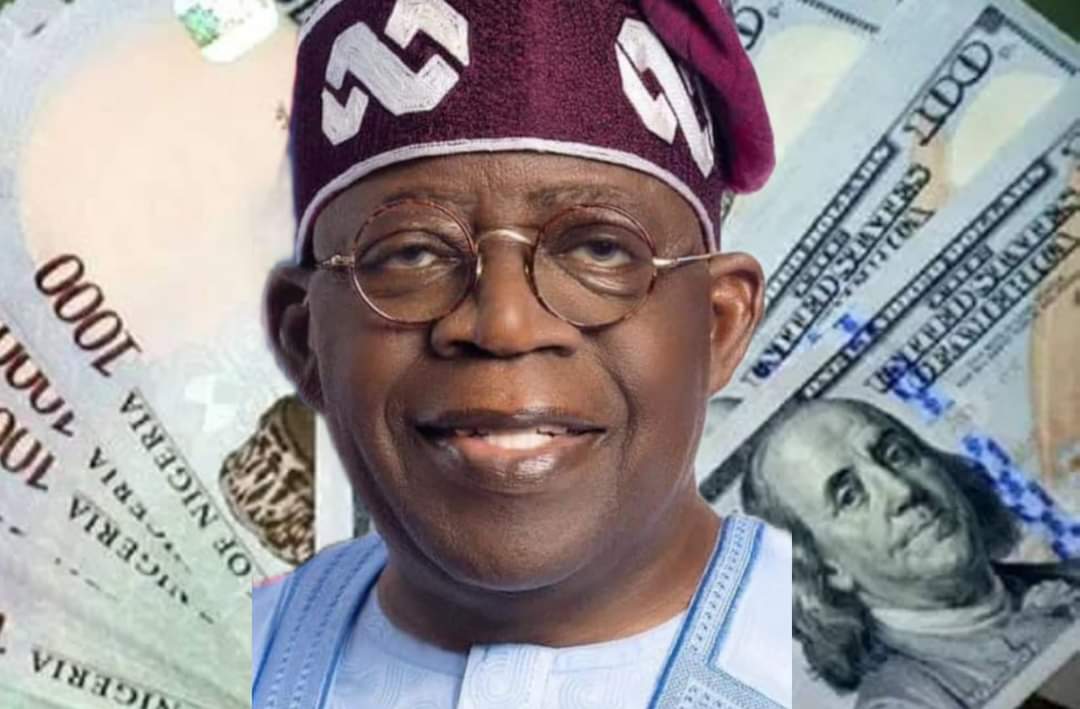

The naira had already been on a downward trajectory against the dollar before Mr. Tinubu assumed office last May, but its depreciation accelerated following the currency’s floatation.

In September, the naira plummeted to N1,000 to one dollar on the parallel market, underscoring the shortcomings of Mr. Tinubu’s efforts to manage the national currency amidst soaring inflation.

In July, the Association of Nigerian Licensed Customs Agents (ANLCA) lamented that the floating of the nation’s currency had resulted in a decrease in vehicle imports at the nation’s ports.

According to Naira Rates, the currency fell to N1,520.123 against the dollar on January 31, compared to its depreciation to N1,482.75 per dollar recorded in the official foreign exchange market on January 30, marking a N38 depreciation within 24 hours.

READ ALSO: Naira Depreciates in Parallel Market, Gains Strength in Official Window

This marked the first instance since the COVID-19 pandemic that the official exchange rate surpassed the parallel market exchange rate, which stood at N1,470 per dollar, up from N1,425 on January 29.

Bola Tinubu’s monetary policies, including the currency floatation, significantly contributed to the naira’s further decline.

A report by Price Water Coopers highlighted that Mr. Tinubu’s economic policies, such as scrapping fuel subsidies and consolidating multiple foreign exchange windows into the single Importer and Exporter (I&E) window, led to a drastic 98 percent depreciation of the naira’s value.

The report indicated that these policies, while appealing to foreign investors, were anticipated to bolster the economy in 2024.

On September 26, the naira hit an unprecedented historical low of N1000 against the U.S. dollar, subsequently losing 17 percent of its value.

The persistent depreciation of the naira underscores the challenges associated with President Bola Tinubu’s fiscal policies, which have led to inflation and reduced economic purchasing power.

Despite the widespread ramifications, including inflation and diminished purchasing power, Mr. Tinubu’s administration has undertaken what his cabinet terms strategic measures.

These include the removal of petrol subsidies, met with resistance and skepticism, aimed at alleviating the government’s financial burden and fostering a more market-driven economy, along with the adoption of a clean float foreign exchange management system.